In his first year at the University of Toronto, Dan (name changed) was a model student. He had a 4.0 GPA, wrote for a campus newspaper, and was on his way to earning a history degree and beginning a career in education. However, due to struggles with student debt, Dan was forced to drop out of university. He is still paying off $18,000 in loans that he incurred while in school.

Dan attributes his struggles with student debt to the Ontario Student Assistance Program (OSAP). Under the program, financial aid is allocated based on a formula that takes into account the student’s income, tuition, and book costs. It also considers parental or spousal income, if applicable. The maximum amount a student can receive is $560 per week.

Dan asserts that this figure does not properly take into account cost of living. In his second year at U of T, for example, OSAP only offered a loan of $5,000, but his tuition was more than $6,000. “[I was] going into debt every month,” Dan says. “I don’t think that’s fair.”

According to the U of T Governing Council’s 1998 Policy on Student Financial Support, “No student offered admission to a program at the University of Toronto should be unable to enter or complete the program due to lack of financial means.” To this end, U of T provides non-repayable grants to students whose financial needs exceed the capabilities of OSAP. Yet some students, like Dan, still drop out of university due to financial concerns.

Today, a record 48 per cent of U of T’s undergraduate students receive OSAP funding. By graduation, these students owe over $20,000 to the government. On average, it takes these students nine and a half years to pay off student debt, at a market-like interest rate of 3.5 per cent. That amounts to $6,448 in interest over the course of the repayment period. Student debt is a reality of education in countries around the world. In Canada, outstanding student loan debt currently stands at over $15 billion. In the United States, outstanding student loan debt stands at over $1 trillion. This is more than their outstanding credit card debt.

Different effects

According to University of Toronto Students’ Union (UTSU) Arts & Science director-at-large Ben Coleman, “the point of OSAP is socioeconomic mobility — an opportunity, through education, to do better than your parents. Where’s the equal opportunity when you have to start your adult life with a debt burden and richer students don’t?”

Student debt limits opportunity, causes stress, and inhibits educational attainment. Many students with high debt loads are forced to take on jobs that limit extracurricular involvement and academic achievement.

Student debt also has spillover effects into other areas of a student’s life. Students with high debt loads are often forced to delay important life decisions. For example, they are less likely to start a small business or pursue further educational opportunities, such as graduate school. They are also more likely to delay home ownership and retirement saving.

Advocating change

“Students see the worst effects of student debts after graduation. Students who end up repaying their loans after graduation end up paying a lot more than students who end up paying up front,” says UTSU vice-president, equity, Yolen Bollo-Kamara.

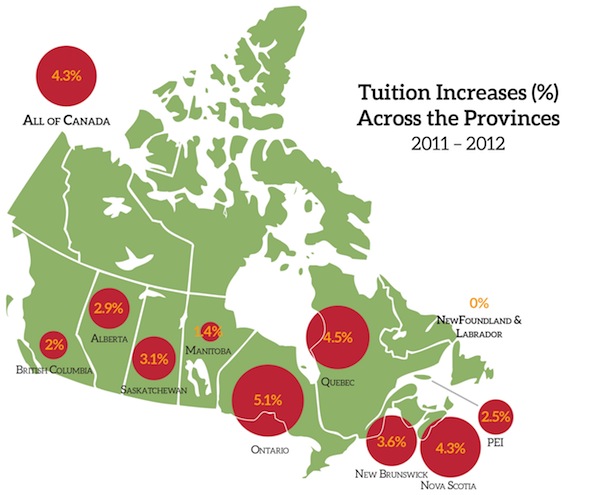

Bollo-Kamara advocates increased provincial funding for post-secondary education. At the moment, Ontario’s spending on post-secondary education per student is the lowest in the country, while Alberta’s is the highest.

Bollo-Kamara also advocates changes to U of T’s institutional interest on tuition fees. “Under the current system, students have to pay 60 per cent of fees up front to be enrolled in classes. After November 15, they start incurring interest on the balance of their tuition,” Bollo-Kamara says. “If students are unable to pay tuition fees up front, they end up paying almost credit-card level interest rates for their tuition.”

Under OSAP, students are allocated financial aid in two installments: in September and in January. According to Bollo-Kamara, this system penalizes disadvantaged students who are unable to pay their tuition fees up front.

Coleman, referencing student debt data for the U of T St. George campus which he received after filing a Freedom of Information request, advocates the implementation of per-semester, per-course tuition. U of T currently operates under a flat-fee model, in which students pay the same tuition whether they take three, four, five, or six courses. Coleman believes that changing the current model will “help OSAP students greatly.”

Dan agrees: “If I was able to take and pay for three courses, I could work a part-time job while attending school.” Under the flat-fee system, this is not feasible.

Another option is to change the interest rate charged to students. At the moment, both the federal and provincial governments charge interest on student loans. In Newfoundland and Labrador, where tuition fees have been frozen since 1999, and in Prince Edward Island, students pay no interest on student loans. A similar system is in place in other countries such as New Zealand.

Benefits of widespread access to education

Allowing widespread access to education promotes innovation and economic growth. More people have the opportunity to attain the skills necessary to fill labour gaps and shortages. According to Statistics Canada, there are currently 5.3 unemployed people for every job vacancy in Canada. Many of these people cannot afford to attain the skills necessary to fill the vacancies. Education also promotes economic mobility. Students with higher education are more likely to determine their own economic outcomes, as opposed to simply taking on the economic position of their parents.

Ontario asserts that it is committed to making post-secondary education accessible to all families, regardless of financial position. To that end, the Ontario Student Access Guarantee offers bursaries, scholarships, work-study programs, and summer employment programs to students who are unable to fully cover their expenses under OSAP.

Still, student debt is a difficult reality of life for many Canadian students. “All I wanted was the chance to get an education,” says Dan. Under the current system of student loans, this goal is unattainable for many Canadian students.